Francisco Church is a rehabilitation specialist and the chief editor of Recovery Ranger. He creates this site to offer guidance and support to individuals seeking...Read more

Medicare is an important health insurance program for many senior citizens and people with disabilities in the United States. One of the benefits of this program is the coverage it provides for prescription drugs. In this article, we will look at which part of Medicare covers prescription drugs to help you better understand how it works.

Contents

- What is Medicare Part D?

- What Is the Coverage Gap?

- What Is the Coverage for Non-Formulary Drugs?

- Few Frequently Asked Questions

- What is Medicare Part D?

- What does Part D cover?

- How much does Part D cost?

- How do I enroll in Part D?

- Do I need to enroll in Part D?

- What if I have a Medicare Advantage plan?

- Medicare Supplement Plans and Prescription Drug Coverage

- Is Diethylpropion A Stimulant?

- Is Alcohol A Inflammatory?

- Does Alcohol Make A Uti Worse?

What is Medicare Part D?

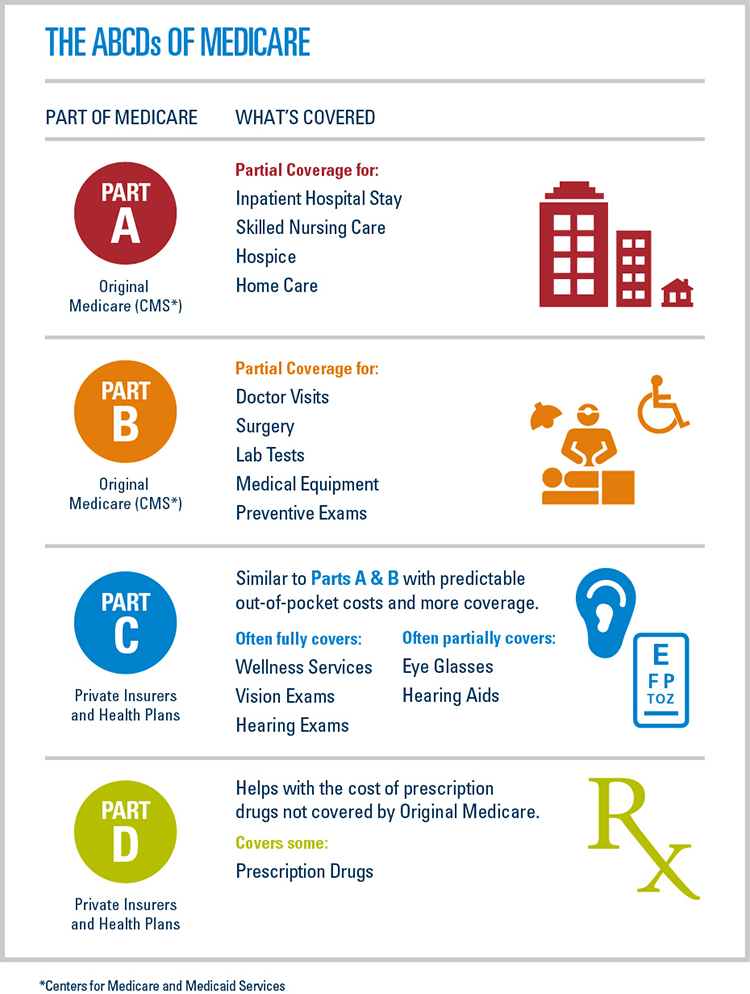

Medicare Part D is a federal program that provides coverage for prescription drugs to people enrolled in Medicare. It was introduced in 2006 as part of the Medicare Modernization Act, and it is administered by private companies that are approved by the Centers for Medicare and Medicaid Services (CMS). Part D plans vary in terms of coverage, cost, and formulary.

Part D plans cover both brand-name and generic prescription drugs. Plans may also offer additional coverage for specific drugs, such as those used to treat cancer or HIV/AIDS. Part D plans are available from private insurance companies and must adhere to certain standards set by CMS.

What Drugs Are Covered by Part D?

Part D plans cover most prescription drugs, including those used to treat acute and chronic conditions. The drugs covered may vary from plan to plan. Most plans cover generic drugs, but some may also cover certain brand-name drugs.

Part D plans may also offer additional coverage for specific drugs, such as those used to treat cancer or HIV/AIDS. The coverage and cost of these drugs may vary from plan to plan.

How Much Does Part D Cost?

The cost of Part D coverage depends on the plan you choose. Most plans have a monthly premium, an annual deductible, and a coinsurance or copayment. The premium and deductible are usually paid directly to the plan, while the coinsurance or copayment is paid to the pharmacy when you fill your prescription.

The cost of Part D coverage may increase each year. However, Medicare offers some financial assistance to help cover the cost of Part D coverage. Eligible beneficiaries may receive extra help with their premiums, deductibles, and coinsurance or copayments.

What Is the Coverage Gap?

The coverage gap, also known as the “donut hole,” is a period in which your Part D plan does not cover the full cost of your prescription drugs. This gap begins after you and your plan have spent a certain amount on covered drugs. Once you reach the coverage gap, you are responsible for paying a larger portion of the cost of your drugs until you reach the out-of-pocket spending limit.

What Is the Out-of-Pocket Spending Limit?

The out-of-pocket spending limit is the maximum amount you have to pay out-of-pocket each year for covered drugs. Once you have reached this limit, your Part D plan will cover the full cost of your drugs for the rest of the year.

What Is the Catastrophic Coverage?

Once you have reached the out-of-pocket spending limit, your Part D plan will provide catastrophic coverage. This coverage helps to cover the cost of your drugs for the remainder of the year. Under catastrophic coverage, you pay either a copayment or coinsurance for your drugs until the end of the year.

What Is the Coverage for Non-Formulary Drugs?

Part D plans may not cover all drugs, including some brand-name drugs. These drugs are known as non-formulary drugs, and your plan may require you to get prior authorization for these drugs or may require you to pay a higher cost-sharing amount.

What Is Prior Authorization?

Prior authorization is a process in which your Part D plan requires you to get approval before it will cover the cost of a non-formulary drug. Your doctor must submit a request to your plan to get prior authorization for the drug.

What Is the Cost-Sharing for Non-Formulary Drugs?

If your Part D plan does not cover a non-formulary drug, you may be required to pay a higher cost-sharing amount. The amount you pay will depend on the plan you have chosen and the type of drug you need.

Few Frequently Asked Questions

What is Medicare Part D?

Medicare Part D is a federal health insurance program that helps cover the cost of prescription drugs for people with Medicare. It is administered by private insurance companies and is available to Medicare beneficiaries who are enrolled in either Medicare Part A or Part B. It is also known as the Prescription Drug Plan (PDP). Part D is an optional benefit that is offered in addition to the standard Medicare coverage.

What does Part D cover?

Part D covers both generic and brand-name prescription drugs that are approved by the Food and Drug Administration (FDA). The plan also covers some over-the-counter medications. It also covers certain preventive medications, such as vaccines and flu shots.

How much does Part D cost?

The cost of Part D depends on the type of plan you choose. Most plans have a monthly premium, an annual deductible, and may also include a copayment or coinsurance. The amount of the monthly premium and the deductible may vary depending on your income level and the plan you choose.

How do I enroll in Part D?

You can enroll in Part D by signing up for a plan through the Medicare Plan Finder on the Medicare website. You can also sign up for Part D through the Social Security Administration or your State Health Insurance Assistance Program (SHIP). You can also contact your local Medicare office or a private insurance company that offers Part D plans.

Do I need to enroll in Part D?

Enrollment in Part D is voluntary, and you do not need to enroll in Part D if you already have coverage for prescription drugs through another plan. However, if you do not have coverage for prescription drugs and need help paying for them, you may want to consider enrolling in Part D.

What if I have a Medicare Advantage plan?

If you have a Medicare Advantage plan, you may have drug coverage either through the plan itself or through a separate Part D plan. You will need to contact your Advantage plan to find out if it includes drug coverage and what drugs are covered. You may also need to enroll in a separate Part D plan if your Advantage plan does not include drug coverage.

Medicare Supplement Plans and Prescription Drug Coverage

As we have seen, Medicare Part D is the part of Medicare that covers prescription drugs. It is important to know what is covered under different parts of Medicare and to carefully review your options. Part D can help you save money on prescription drugs while also providing access to the medications you need to stay healthy. Ultimately, understanding Medicare Part D can help you save money and access the medications you need.

Francisco Church is a rehabilitation specialist and the chief editor of Recovery Ranger. He creates this site to offer guidance and support to individuals seeking to overcome addiction and achieve lasting sobriety. With extensive experience in the field of addiction treatment, Francisco is dedicated to helping individuals access the resources they need for successful recovery.

- Latest Posts by Francisco Church

-

Is Diethylpropion A Stimulant?

- -

Is Alcohol A Inflammatory?

- -

Does Alcohol Make A Uti Worse?

- All Posts