Francisco Church is a rehabilitation specialist and the chief editor of Recovery Ranger. He creates this site to offer guidance and support to individuals seeking...Read more

Addiction counselors have an important job in helping people overcome their addiction, but what about billing insurance for their services? It is a tricky question, and one that has been debated over the years. In this article we will look at whether or not addiction counselors can bill insurance and discuss the pros and cons associated with it. We will also discuss the ethical considerations associated with this practice. By the end of this article, you will have a better understanding of the implications of addiction counselors billing insurance and how to move forward in a responsible manner.

Contents

- Can Addiction Counselors Bill Insurance?

- Related Faq

- 1. What is Addiction Counseling?

- 2. What Types of Insurance Can Addiction Counselors Bill?

- 3. What Information Is Needed to Bill Insurance?

- 4. What Are the Benefits of Billing Insurance?

- 5. What Are the Challenges of Billing Insurance?

- 6. What Other Resources Are Available for Addiction Counselors?

- Is Diethylpropion A Stimulant?

- Is Alcohol A Inflammatory?

- Does Alcohol Make A Uti Worse?

Can Addiction Counselors Bill Insurance?

Addiction counselors, who provide help to those struggling with substance abuse and addiction, often have to figure out how to cover their services. Because addiction is a recognized medical condition, some addiction counselors can bill insurance for their services. This can be an attractive option for those seeking help, as it can help to make treatment more accessible.

What Does Insurance Cover?

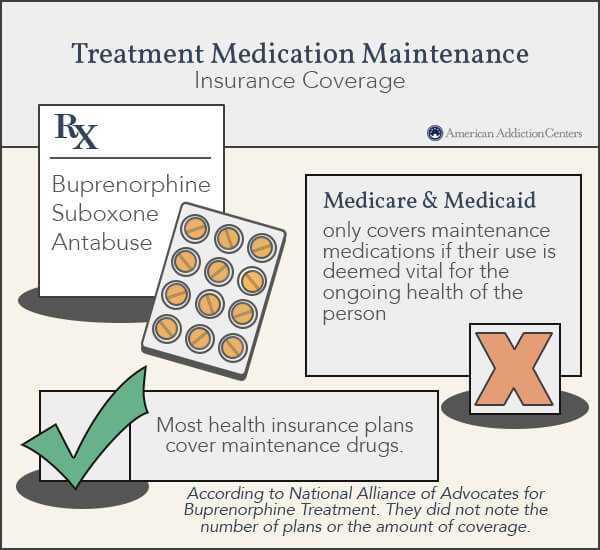

The extent to which insurance covers addiction counseling services varies from plan to plan. Generally, insurance will cover some of the cost of addiction counseling, but it is important to note that not all services are covered. It is best to check with your insurance provider to find out what services are covered, so that you can make an informed decision about treatment.

In general, insurance will cover the cost of individual and group counseling sessions, as well as certain medications that may be prescribed. It may also cover the cost of certain addiction-related treatments, such as cognitive-behavioral therapy, motivational interviewing, and family therapy. However, it is important to note that not all insurance plans will cover all of these services.

What Are the Benefits of Insurance Coverage?

One of the main benefits of insurance coverage for addiction counselors is that it can make treatment more accessible to those who need it. Insurance can help to cover the cost of treatment, making it easier for those struggling with addiction to access the help they need.

Additionally, insurance coverage can help to reduce the stigma associated with addiction and addiction counseling. Insurance companies are more likely to cover addiction counseling services if they are seen as a necessary part of treatment, which can help to reduce the stigma associated with addiction and addiction counseling.

How Do I Find an Addiction Counselor Who Accepts Insurance?

If you are looking for an addiction counselor who accepts insurance, it is important to do your research. There are several online resources that can help you find a counselor who accepts insurance, such as AddictionResource.com. Additionally, you can contact your insurance provider to find out if there are any addiction counselors in your area who accept your insurance.

What Are the Challenges of Billing Insurance?

One of the challenges of billing insurance for addiction counseling services is that there are often complicated rules and regulations that must be followed. For example, some insurance companies require pre-authorization for certain services, which can be time-consuming and difficult to navigate. Additionally, insurance companies may not cover all services, which can be a challenge for those seeking help.

What Are the Benefits of Working with an Insurance Provider?

Working with an insurance provider can have several benefits for addiction counselors. For example, insurance companies often provide resources and support to help counselors navigate the billing process. Additionally, insurance companies can provide access to resources that can help addiction counselors better serve their clients. Finally, working with an insurance provider can help to reduce the financial burden of providing treatment, which can make it easier for counselors to focus on helping their clients.

Related Faq

1. What is Addiction Counseling?

Addiction counseling is a type of therapy that is focused on helping individuals overcome addiction by understanding the underlying causes and developing tools and skills to cope with cravings and triggers. Addiction counselors work with individuals, as well as families and communities, to develop personalized plans to address the individual’s addiction. This may include cognitive behavioral therapy, motivational interviewing, mindfulness, and other therapeutic approaches.

2. What Types of Insurance Can Addiction Counselors Bill?

Addiction counselors can bill a variety of insurance providers, including private health insurance, Medicare, Medicaid, and Tricare. Each insurance plan is different and may have restrictions on what types of services can be billed. It is important for the addiction counselor to be familiar with the specific insurance plan in order to ensure that they can bill for the services provided.

3. What Information Is Needed to Bill Insurance?

In order to bill insurance for addiction counseling, the addiction counselor will need the patient’s insurance information, including the name of the insurance provider, policy number, and subscriber information. The counselor will also need to provide a diagnosis code for the patient’s condition and detail the services provided. The counselor will also need to provide documentation of the services provided in order to bill the insurance provider.

4. What Are the Benefits of Billing Insurance?

Billing insurance for addiction counseling can be beneficial to both the patient and the counselor. For the patient, it can reduce the cost of treatment, as insurance may cover some or all of the cost. For the addiction counselor, it can provide a steady source of income and help ensure that they are properly compensated for the services they provide.

5. What Are the Challenges of Billing Insurance?

Billing insurance for addiction counseling can be challenging due to the complexity of insurance plans, the amount of paperwork involved, and the potential for denials or delays in payment. It is important for the addiction counselor to be familiar with the insurance plan and to be prepared to provide documentation of services in order to avoid problems with billing.

6. What Other Resources Are Available for Addiction Counselors?

In addition to billing insurance, there are a number of other resources available to addiction counselors. These include grants, scholarships, fellowship programs, and professional organizations that can provide support and resources. Additionally, some states offer loan forgiveness programs for addiction counselors, which can help reduce the cost of education and training.

In conclusion, addiction counselors can bill insurance, but they have to have the proper credentials and knowledge of the insurance company’s policies. Although it can be a complicated process, it is an important part of providing services to those suffering from addiction. With proper knowledge and understanding, addiction counselors can provide their clients with the best possible care, while also giving them access to financial assistance through insurance.

Francisco Church is a rehabilitation specialist and the chief editor of Recovery Ranger. He creates this site to offer guidance and support to individuals seeking to overcome addiction and achieve lasting sobriety. With extensive experience in the field of addiction treatment, Francisco is dedicated to helping individuals access the resources they need for successful recovery.

- Latest Posts by Francisco Church

-

Is Diethylpropion A Stimulant?

- -

Is Alcohol A Inflammatory?

- -

Does Alcohol Make A Uti Worse?

- All Posts